Navigating the intricacies of Australian tax laws amidst today’s complex financial arena is crucial for individuals and small businesses alike. With the assistance of expert business advisory services and specialised taxation services provided by professional accountants, safeguarding tax obligations becomes paramount. These services extend beyond mere compliance, offering tailored guidance to optimise financial strategies and maximise savings.

In this article, we delve into unique methods to ensure the security of your tax, promoting peace of mind and fostering financial stability.

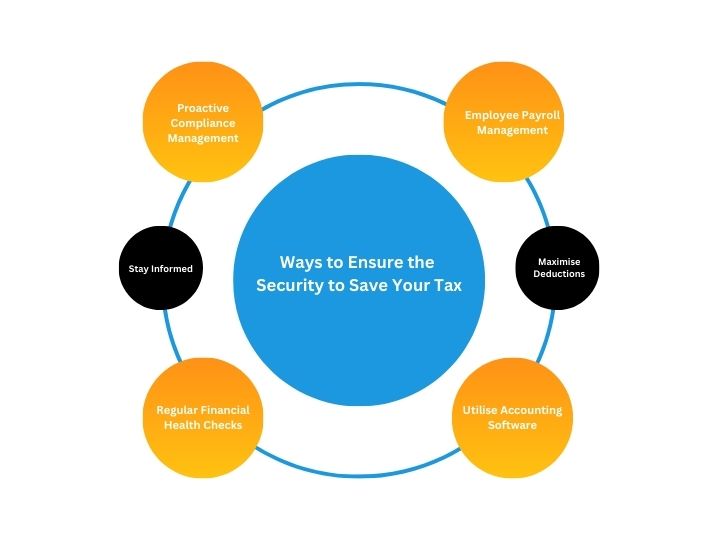

From proactive compliance management to leveraging accounting payroll services, we explore actionable steps to mitigate risks and enhance tax efficiency. By harnessing the expertise of accountants for small businesses near you and embracing innovative solutions in small business tax and accounting, individuals and enterprises can confidently navigate the world of tax, safeguarding their financial interests for the future.

Understanding Taxation Services

In grasping the nuances of taxation services, individuals and businesses can harness the expertise of professional accountants to navigate the complex world of tax regulations. These professionals offer a comprehensive suite of business advisory services and taxation services tailored to meet the diverse needs of their clients.

1. Preparation and Lodgment of Tax Documents

One of the primary functions of professional accountants is the meticulous preparation and lodgment of essential tax documents. From Business Activity Statements (BAS) to Company Tax Returns (CTR), these experts ensure accuracy and compliance, mitigating the risk of penalties and optimising tax outcomes.

2. Expert Advice on Business Structuring and Compliance

In addition to document preparation, taxation services encompass strategic advice on business structuring and compliance with government regulations. With a deep understanding of local tax laws, professional accountants provide invaluable guidance on structuring businesses for optimal tax efficiency while ensuring adherence to regulatory requirements.

3. Day-to-Day Operational Support

Beyond periodic tax filings, professional accountants offer small businesses day-to-day operational support. This includes assistance with accounting payroll services, ensuring accurate wage calculations, tax withholdings and compliance with employment regulations. By leveraging the expertise of accountants for small businesses near me, individuals and enterprises can navigate the intricacies of tax obligations with confidence, laying the foundation for financial success and stability.

Key Strategies for Tax Security

In the world of tax security, proactive measures are paramount to ensure compliance and financial stability. Leveraging a combination of expert business advisory services and specialised taxation services provided by professional accountants can significantly enhance your tax security posture.

1. Proactive Compliance Management

Engaging with professional small business tax and accounting services empowers you to stay ahead of compliance requirements. By partnering with experts who specialise in tax regulations, you can maintain accurate records and ensure timely submissions, thus avoiding penalties and maintaining smooth operations.

2. Regular Financial Health Checks

Schedule periodic reviews of your financial statements with accountants for small businesses near me. These assessments serve as valuable checkpoints, identifying potential areas of improvement and ensuring that your tax obligations are met accurately. Regular financial health checks enable proactive adjustments to your financial strategies, optimising tax outcomes.

3. Utilise Accounting Software

Implementing robust accounting software such as Xero, MYOB, or Quickbooks, with the assistance of experts in accounting payroll services, streamlines financial processes. These tools not only reduce errors but also enhance overall efficiency, allowing for seamless management of financial data and simplifying tax-related tasks.

4. Employee Payroll Management

Outsourcing payroll services to professionals proficient in accounting payroll services ensures accurate handling of employee wages, taxes and compliance. By entrusting payroll responsibilities to experts, you can mitigate risks associated with payroll errors and focus on core business activities.

5. Stay Informed

Keep abreast of tax law and regulation changes through regular updates and consultations with small business accounting and tax advisors. By staying informed, you can adapt your financial strategies to minimise tax liabilities and maximise savings. Collaborating with knowledgeable advisors ensures that you are well-equipped to navigate the intricacies of the evolving tax environment effectively.

6. Maximise Deductions

Leverage available deductions and credits to optimise your tax position. Seek guidance from experienced professional accountants to identify eligible expenses and ensure compliance with applicable regulations. By maximising deductions, you can effectively minimise your tax burden and retain more of your hard-earned income.

7. Plan for the Future

Develop a strategic tax plan tailored to your long-term financial goals with the assistance of business advisory services. By anticipating tax implications and implementing proactive measures, you can secure your financial future and position yourself for long-term success. A well-crafted tax plan not only minimises immediate tax liabilities but also supports your broader financial objectives.

Optimising Tax Security with ASA Taxation & Accounting Services

Safeguarding your tax obligations necessitates proactive steps and expert guidance from professionals in business advisory services and taxation services. Through strategies like proactive compliance management, regular financial health checks and the effective utilisation of accounting software, individuals and small businesses can protect their tax interests and optimise savings.

By embracing these measures, individuals and enterprises can navigate the problems or complexities of tax regulations with confidence, ensuring financial security and stability for the future. For comprehensive financial and operational support, trust ASA Taxation & Accounting Services.

Our team of experts specialises in preparing annual financial statements, locating BAS and CTR, providing business structuring advice, managing compliance, providing payroll services and more. Contact us today to safeguard your tax and optimise your financial success.